Why Corporate PPAs Are Rising on the Agenda

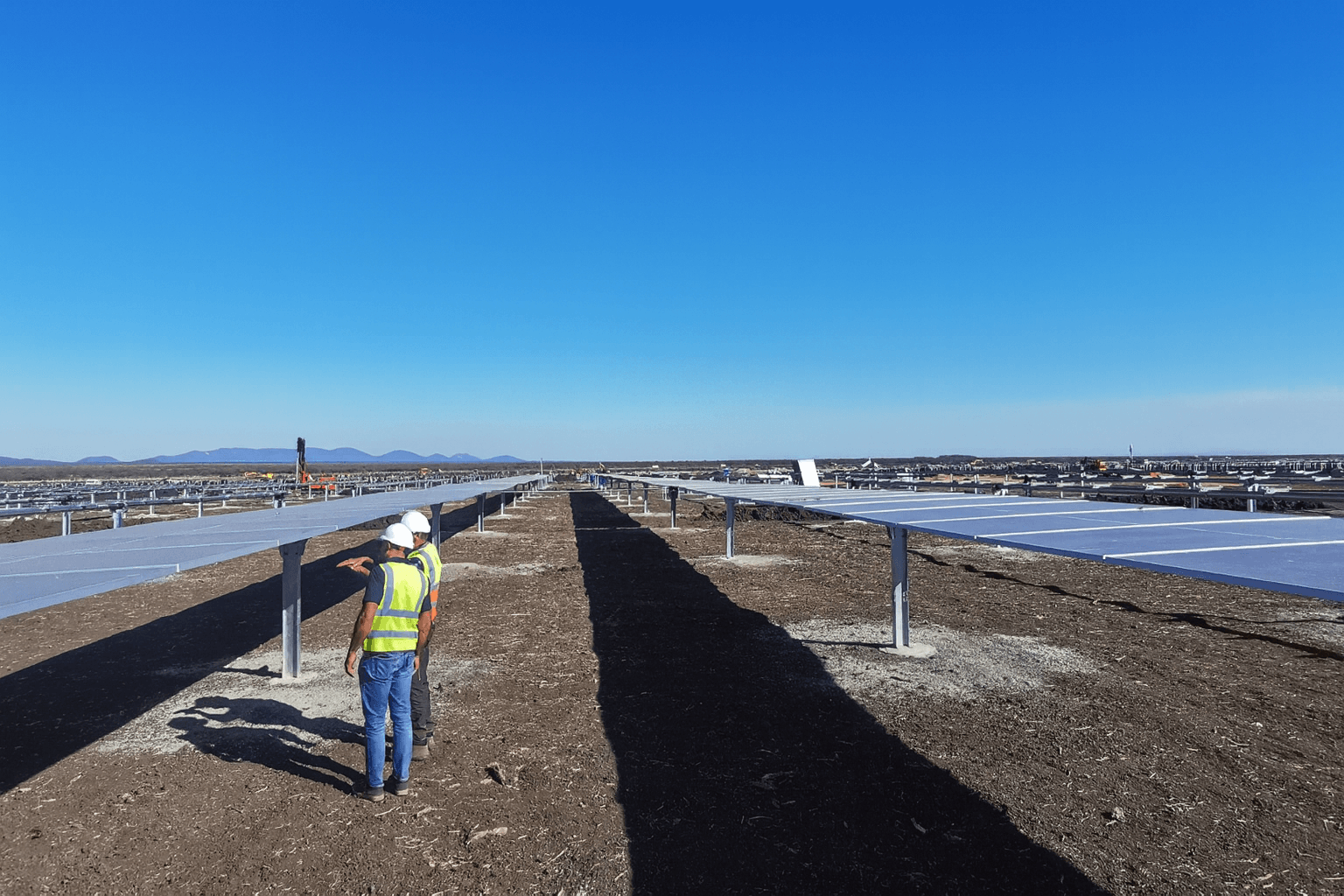

South Africa’s energy landscape is changing rapidly. Regulatory changes and the adoption of renewable technologies are reshaping how large energy users such as mining companies, smelters and manufacturers procure electricity. For many, electricity procurement strategy is increasingly emerging as a strategic lever that influences competitiveness, sustainability positioning and security of energy supply.

Against this backdrop, corporate Power Purchase Agreements (PPAs) have emerged as the most common contracting model to secure long-term supply of renewable energy. According to Transparency Market Research the global PPA market was valued at $20.1 billion in 2022 and is projected to increase to nearly $400 billion by 2031. South Africa is part of this shift, with leading corporates and mining companies alike frequently using PPAs to contract for a significant portion of their energy requirements.

Breaking Down the PPA Model

At their core, corporate PPAs are long-term contracts between Independent Power Producers (IPPs) and corporate buyers (Offtakers). The IPP develops and operates a renewable energy project, while the Offtaker commits to purchase electricity from that project at a contracted tariff for a defined term. The framework is simple, but – given the obligations of the parties – the contracts tend to be lengthy with extensive drafting common.

Key elements include: –

- Contract duration: Historically 10–20 years, but more recently as short as 12-24 months;

- Tariff structures: Fixed or CPI-indexed;

- Delivery models: On-site, wheeled or hybrid structures that combine self-generation, storage, and grid supply;

- Volume commitments: Either take-or-pay (buyer purchases all output) or as-consumed (seller matches buyer demand).

Key Risks for Corporate PPAs

1. Offtaker Credit & Payment Risk

Corporate PPAs rely on the buyer’s financial strength as delayed payments or defaults expose IPPs to revenue loss. Credit checks, guarantees and security structures are therefore critical.

2. Tariff & Revenue Risk

For buyers, poorly negotiated tariffs or escalation clauses can erode projected savings over time. Volume uncertainty – especially under as-consumed models – also creates risks in addressing CO2 reduction targets.

3. Grid Access & Wheeling Risk

Eskom and municipal wheeling frameworks are complex and constantly evolving. Delays, curtailment and grid congestion can impact on timelines and project economics with a need to identify risk-allocation mechanisms between buyer and seller.

4. Regulatory & Policy Risk

NERSA registration processes and changes in Carbon Tax or local content requirements all also have the potential to affect project economics.

5. Termination & Default Risk

Given the reliance on limited-recourse project finance in corporate PPAs transactions, lenders typically look for parent company guarantees, step-in rights and clear default remedies to compensate for the relatively low cost of funding.

Opportunities on the Horizon

1. Long-Term Revenue Stability

Contracted long-term cashflows enhance bankability and attract competitive financing.

2. Rising Demand for Renewables

Corporate ESG commitments and decarbonisation targets are driving strong demand for solar, wind and storage-backed PPAs.

3. Cost Savings for Offtakers

Private PPAs often deliver cheaper tariffs than Eskom, making them attractive for energy-intensive industries.

4. Flexible Contract Structures

Bespoke terms, innovative delivery models and hybrid storage solutions are expanding the scope of PPA design.

5. Grid Decentralisation & Energy Trading

Regulatory shifts are enabling wheeling and private energy trading, expanding market access beyond Eskom.

6. PPAs operate in parallel with SAWEM (South African Wholesale Electricity Market)

Closing Thought

Corporate PPAs have been a cornerstone of South Africa’s energy transition to date, balancing risk with opportunity. While creditworthiness, grid access and regulatory uncertainty remain major challenges, the upside – long-term price visibility, lower costs, and alignment with sustainability goals – mean they are likely to continue to play a vital role into the future.